Author: Ginger Ding

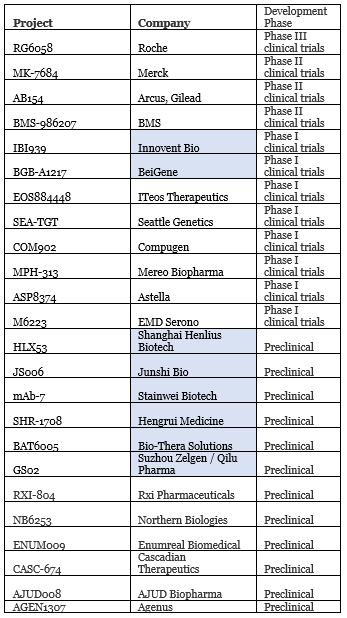

Following PD-(L)1, high-end players have quickly joined the race to develop the new star T cell immunoreceptors with immunoglobulin and ITIM domain (TIGIT). Roche, BMS, Merck and other international pharmaceutical companies have all entered. Meanwhile, in China, BeiGene, Innovent Bio, Junshi Bio, Hengrui Medicine, and other companies are also contributing to TIGIT R&D. In 2020, both Innovent and BeiGene’s TIGIT antibodies successfully initiated clinical trials.

Companies with TIGIT projects in R&D; blue indicates Chinese companies

When asked which product on the R&D pipeline is most anticipated, BeiGene scientific founder Wang Xiaodong said: “From my personal point of view, it should be the TIGIT antibody.” 【1】iTeos CEO Michel Detheux also boasted: “TIGIT antibody drug may become the first new-generation immunotherapy after PD-1/PD-L1 to pass Phase III clinical trials.”

Due to PD-(L) and other cancer immunotherapy markets on the rise, even if there are no products approved, TIGIT-related collaborations have continued to emerge both in China and around the world:

1. In 2018, Qilu Pharma obtained exclusive rights for Zelgen’s TIGIT antibody GS02 in Greater China.

2. In 2018, Astellas purchased Potenza Therapeutics for US$400 million in order to further develop its cancer immunotherapy layout, including the three antibodies TIGIT, NRP1 and GITR.

3. In 2019, Mereo BioPharma acquired Oncomed Pharmaceuticals, including four projects including the TIGIT antibody etigilimab (now called MPH-313).

4. In 2020, AstraZeneca announced a collaboration with Arcus Biosciences to jointly evaluate the TIGIT antibody AB154 combined with the PD-L1 inhibitor duvalizumab.

However, just after AstraZeneca joined the TIGIT competition on October 29, 2020, the news that Astella’s quietly removed the TIGIT antibody ASP8374 project from their R&D pipeline broke 【2】. An Astellas spokesperson stated that the termination of the project was “because the Phase 1 study did not meet the criteria to continue.” In June last year, Celgene also decided to stop co-development of the TIGIT antibody MPH-313 with Mereo BioPharma. The reason behind this is unclear; it could be related to the acquisition of BMS or because there was no confidence in TIGIT.

In this way, is it possible that the highly sought-after TIGIT will follow in the footsteps of IDO inhibitors and fade away?

Evaluation of Roche’s RG6058 clinical trial data

As the leader in TIGIT, the latest clinical data released by ASCO in 2020 by Roche is meaningful. On the one hand, it brings hope to investors and players in the industry, and on the other hand, it is also worthy of scrutiny.

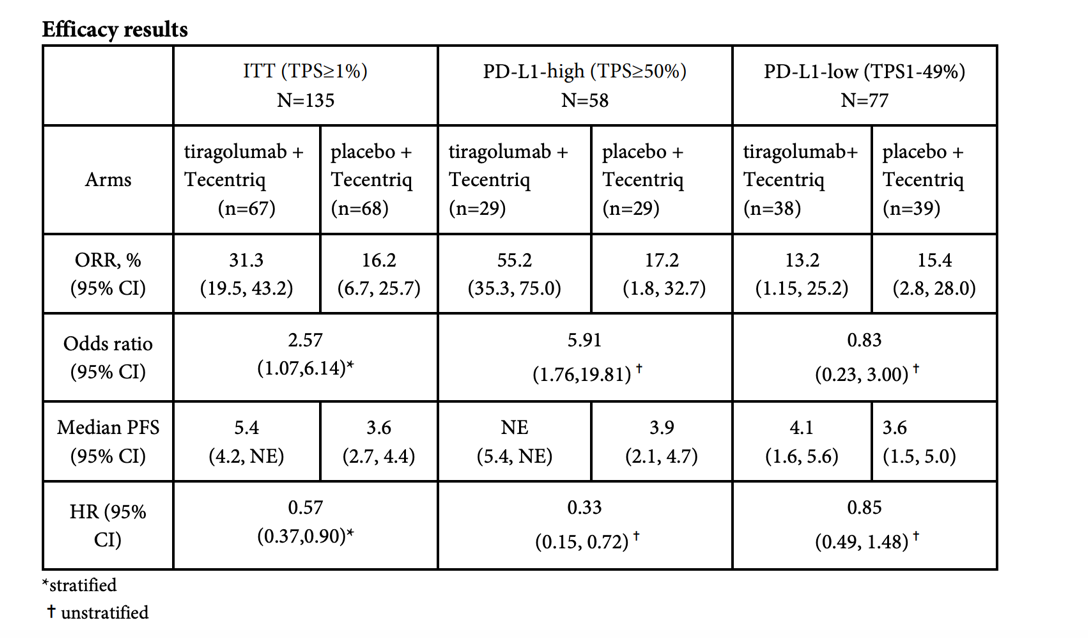

Let’s look at the data first: 135 patients with NSCLC (non-small cell lung cancer) were randomly assigned to the RG6058+ atezolizumab and Placebo+ atezolizumab groups. With an average follow-up of 10.9 months, the objective response rate (ORR) of RG6058 combined with atezolizumab was significantly improved (31.3% VS 16.2%), and the median progression-free survival was compared with atezolizumab alone. The period (PFS) has also improved significantly (5.4 months VS 3.6 months).

Overall, it seems that all the data is clinically significant. Let’s look at the broken down data:

Source: Roche public data

When atezolizumab is combined with TIGIT therapy, PD-L1 high populations have the following result: ORR is 55.2% vs 17.2%, HR=0.33. However, in PD-L1 1-49% population, when combination therapy is compared to atezolizumab alone it has no advantages. Thus, the preliminary conclusion is that the combination therapy is only effective for people with high PD-L1 expression.

In other words, the combination therapy of TIGIT and PD-(L)1 does not seem to be able to solve the old problem of “cold tumors” in the field of cancer immunotherapy, so its market value has been greatly discounted.

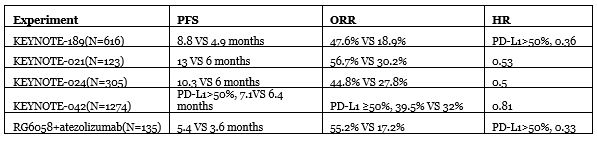

Next, let’s compare other clinical trials for NSCLC, taking the approved combination of pembrolizumab + chemotherapy as an example:

Judging from the above table, performance is not bad for the time being, but the choice of atezolizumab as a placebo is a bit questionable given that it was approved only for high PD-L1 populations. Furthermore, so far, the “golden standard” overall survival rate has not yet begun to be tested and remains to be seen.

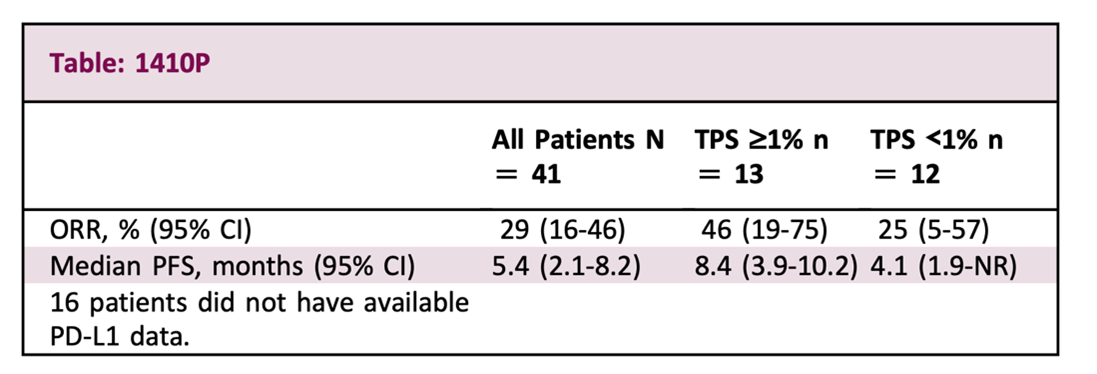

After Roche’s data came out, Merck also announced early clinical trial data on EMSO in September. Although there was no control group, the results showed that after an average follow-up of 11 months (Roche’s 10.9 months), ORR was 46%, slightly better than Roche’s 31.3%, and PFS was 8.4 months. Similarly, the combination is effective also based on the patient’s PD-L1 being only higher than 1% on average.

Source: EMSO

Back to the starting point

Since the clinical trial data is limited, let us go back to the starting point and see what enlightenment some basic research can bring.

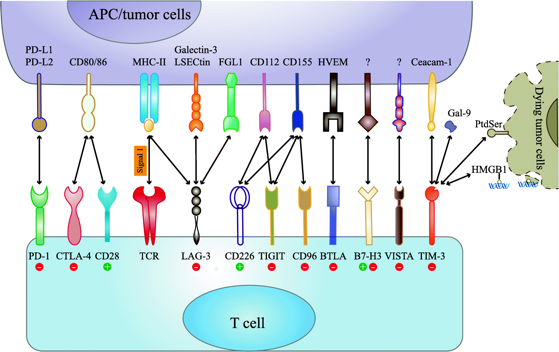

TIGIT was first discovered by the Genentech team under Roche in 2009【3】. TIGIT is specifically expressed on NK cells and T cells. There are three binding partners for TIGIT in total, namely CD155, CD112 and CD113, among which CD155 have the highest affinity.

Unlike most known immune checkpoints, TIGIT and ligand maintain a non-exlcusive relationship. This gives two clues. First, the mechanism of TIGIT is relatively more complicated. Second, the effect of inhibiting TIGIT may be limited.

Immune checkpoint interaction

Source: Mol Cancer 18, 155 (2019)

There are still many differing opinions about the mechanism of TIGIT. One view is that TIGIT can compete with CD226 to bind to CD155 and inhibit the anti-tumor immune response of T cells and NK cells, similar to CTLA-4. Another view is that TIGIT interferes with the homology of CD226 dimerization, thereby inhibiting the anti-tumor immune response of CD226.

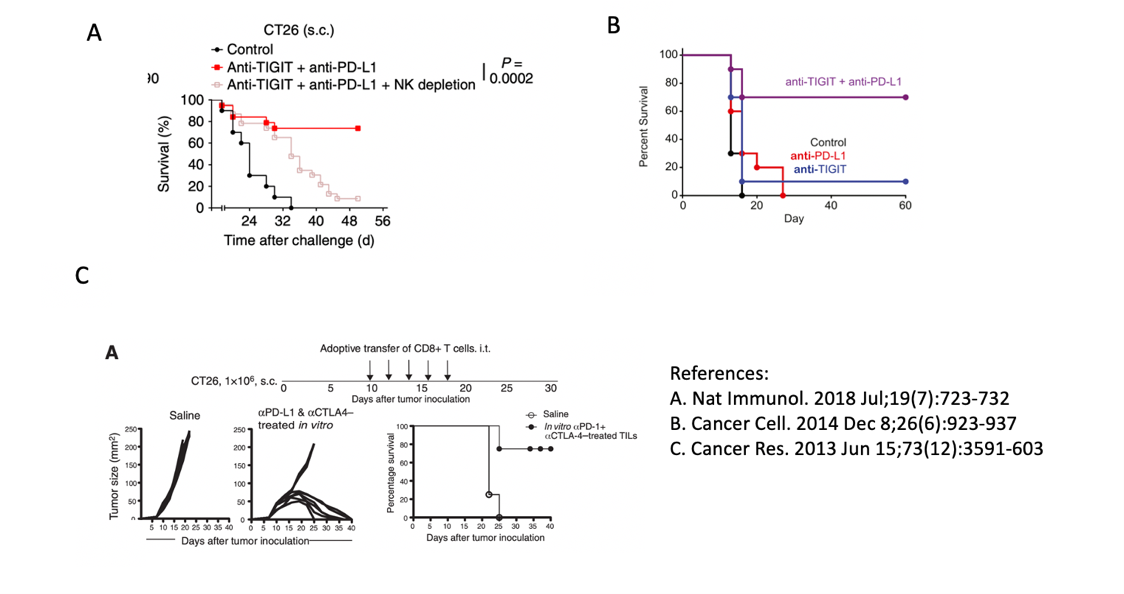

Although it is not clear which signal pathway is the main one, the conclusion that the TIGIT antibody and PD-(L)1 inhibitor can synergistically activate the immune system to kill tumors is well accepted. TIGIT+PD(L)1 combined animal experiments are mainly based on colon cancer models, such as CT26.

Experimental data of the survival rate of mice with combination therapy; A and B (TIGIT+PD-L1), C is CTLA4+PD-L1

CTLA4 is a popular target for PD-(L)1 combined use, especially for NSCLC. Several clinical trials are already underway, such as the one named Checkmate 592. Therefore, I tried to find some data that can be compared with TIGIT, or at least that used the same animal models.

Although the treatment regimens are not exactly the same, it can be seen that after the combination of the TIGIT or CTLA4 and PD-(L)1 antibody, the survival rate of mice at 40 days is equivalent, reaching nearly 80%.

Judging from the above clinical trial and preclinical data, the combination of TIGIT+PD-(L)1 inhibitors against “cold tumors” is not very optimistic, and the potential of a single drug is limited, making a combo necessary.

Fc or no Fc

Of course, the effect may also be related to antibody design. Although they are all TIGIT antibodies, taking a closer look reveals some major differences.

Source: Nat Biotechnol. 2020 Sep; 38(9):1007-1009

The significant difference of existing TIGIT antibodies lies in their Fc region. Both Roche and Merck’s use wild-type IgG1, and BeiGene’s BGB-A1217 also has complete Fc functions. Maintaining Fc can maintain TIGIT-directed antibody-dependent cytotoxicity (ADCC), promote dialogue between T cells and antigen presenting cells, enhance specific T cell responses without being disturbed by Treg cells. However, at the same time Fc may also harm cytotoxic T cells.

To be on the safe side, Arcus and BMS chose to deactivate the Fc region mutant IgG1, and Compugen and Astella used the weaker Fc IgG4. Seattle Genetics went the other way, choosing IgG1 with glycosylation enhanced Fc.

The question of whether to take or leave Fc has been inconclusive. The author’s previous article “Can CD47 successfully become a star target in the post-PD-(L)1 era?” also talked about this issue.

As far as TIGIT is concerned, although the mouse data from Merck & Co., Ltd. and other companies indicate that Fc binding is essential for reducing tumor activity【4】, the clinical difference between Fc wild type and Fc mutant type needs to wait for the Arcus or BMS data to be further evaluated.

Summary

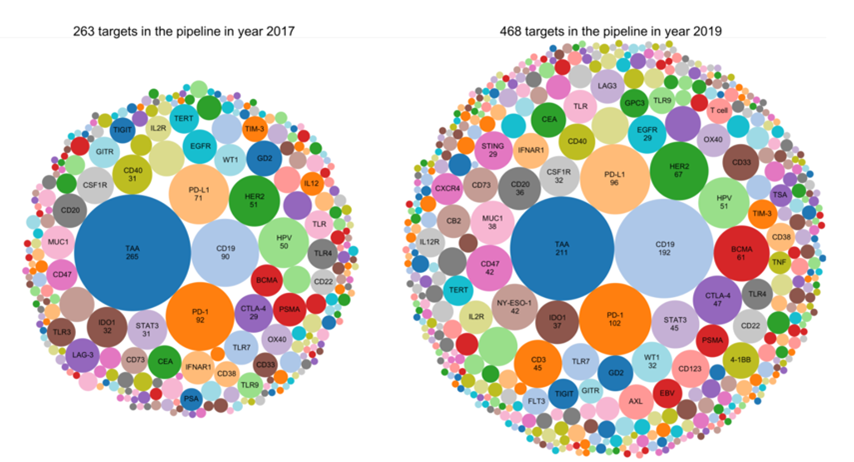

After the first PD-1 inhibitor Keytruda was approved in 2014, major companies have slowly shifted from the development of PD-(L)1 to that of combination therapy. Players who have tasted the rich dividends of PD-1 are striving to maintain their dominant position. Other companies are also worried about missing out on a good opportunity again and have joined in an attempt to overtake their competitors. The number of PD-(L)1 combined targets in R&D pipelines have increased from 263 in 2017 to 468 in 2019 【5】.

Returning to the first question raised in the article, will TIGIT eventually fade away?

From the objective data, it still has remarkable potential, but like other “blockbuster” targets, even if the TIGIT antibody is promising, there are now more than a dozen companies entering clinical trials, two which are in China. When referring to what happened with PD-( L)1, there is a market quota of each competitor and the return on investment for latecomers is very limited, unless the antibody can be optimized to become the best-in-class with absolute clinical advantages, especially in regions where the drug pricing war is quite brutal, such as in China.

About the author

Dr. Ginger Ding is the Director of Investment Analysis at MyBioGate and a Consultant for the Texas Medical Center and Columbia University Consulting Club. She has worked at the Howard Hughes Medical Institute and MD Anderson Cancer Center. During that period, she participated in the preclinical research of tumor brain metastasis and received funding from the National Institutes of Health RO1, Susan G. Komen, and Taiho Pharmaceutical.

References

1. How does BeiGene recreate the largest equity financing case for biotech? After PD-1, Wang Xiaodong looks forward to this product most

2. In early blow to Kenji Yasukawa’s R&D revamp, Astellas drops out of the TIGIT race, citing PhI failure

3. Nat Immunol. 2009 Jan; 10(1):48-57.

4. Requirement of Fc gamma receptor-mediated myeloid-cell activation for effective cancer immunotherapy with an anti-TIGIT antibody

5. Nat Rev Drug Disco. 2019 Nov; 18(12):899-900