Author: Ginger Ding

The rate of return on investment in new drugs has steadily declined; it is imperative to improve R&D efficiency

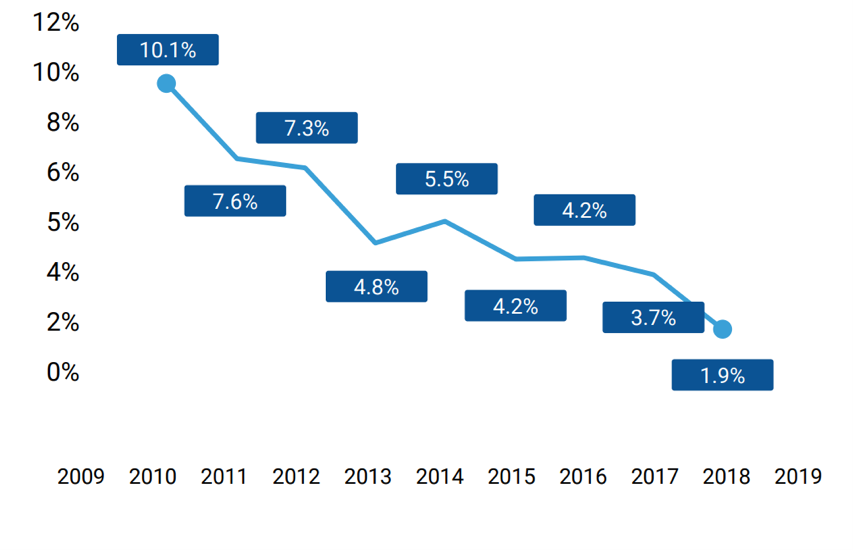

New drug research and development has three characteristics that may raise concerns: high cost (985.3 million [1]), a long R&D cycle (10-12 years), and a low success rate (13.8% [2]). In fact, the return on investment in drug development has steadily declined from 10.1% in 2010 to 1.9% in 2018 [3]. This is especially true for some complex diseases. In the past decades, more than 50 clinical trials have failed to show any positive effects treating Amyotrophic lateral sclerosis (ALS) [4].

Therefore, reducing R&D costs, increasing success rates, shortening the cycle, and developing differentiated, competitive, and high-tech drugs are issues that major pharmaceutical companies urgently need to solve.

▲Figure 1: Return on investment in drug development

Source: Deep Knowledge Analytics

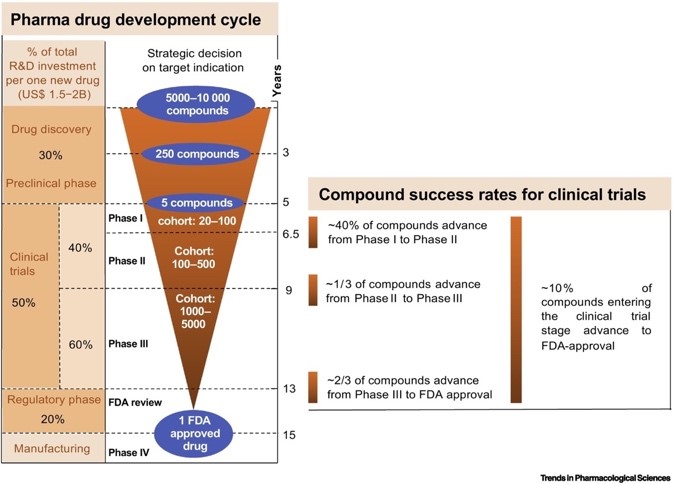

About one-third of the cost of new drug development is spent on new drug discovery and the preclinical stage [5], which takes five to six years. Generally speaking, out of 10,000 compounds discovered, only about ten can enter clinical trials, and the success rate of entering the phase I clinical trials is slightly less than 10% [6]. This shows that improving the success rate of new drug discovery is very important for drug development .

▲Figure 2: Drug development cycle

Source: Trends Pharmacol Sci.2019 Aug;40(8):577-591

AI-driven new drug discoveries have a huge market potential, with a compound annual growth rate of 40%

With the rapid accumulation of drug R&D data and digital transformation, as well as the accelerated development of artificial intelligence technology (AI), the application of AI in new drug discovery is increasing, and the advantages are also prominently reflected.

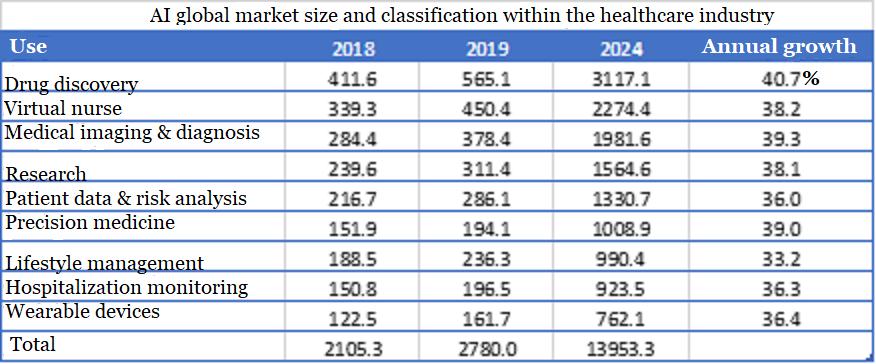

BCC data shows that in all application scenarios of AI in the medical and health industry, the application of new drug discovery takes the lead, in market size or growth rate,. It is expected to reach 3.1 billion US dollars in 2024, with a compound annual growth rate of 40%.

▲Figure 3: AI global market size and classification within the healthcare industry

Source: BCC

AI gives five major advantages to new drug discovery, reducing costs about 35%

AI can optimize decision-making and innovation in addition to improving the efficiency of research and clinical trials and creating new tools. Compared with traditional new drug discovery, AI new drug discovery has the following advantages:

- Shortening the time of new drug discovery

The traditional way of new drug discovery takes 3-5 years of screening for obtaining clinical trial candidates . The AI-driven new drug discovery only takes 1-2 years or even months.

- Saving costs and increasing net income

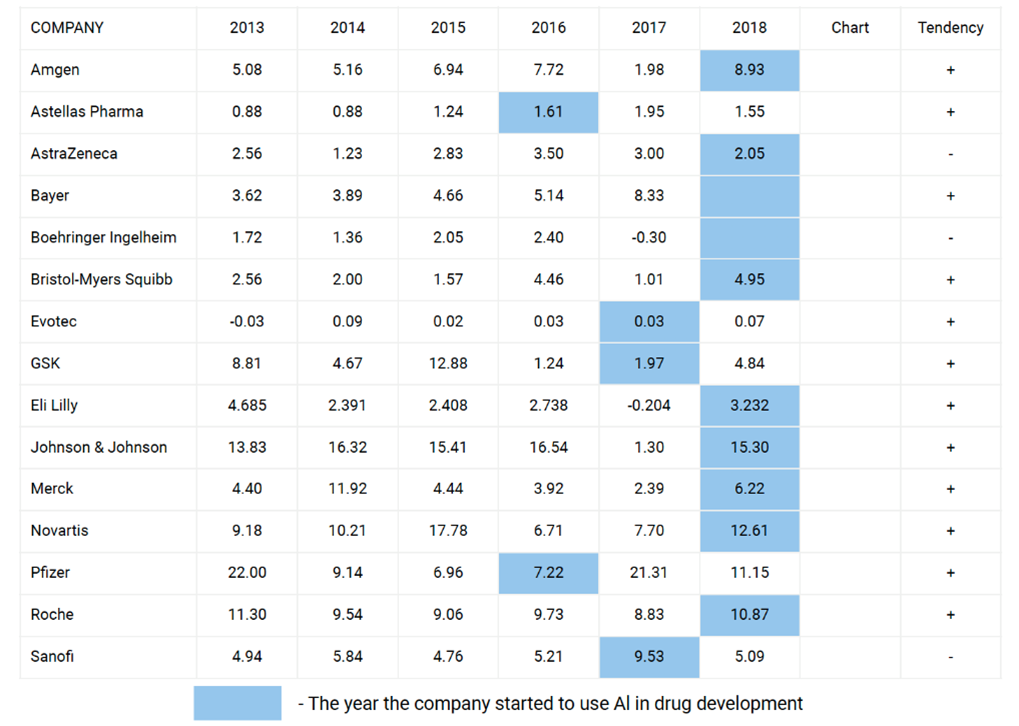

Since AI can shorten the cycle of new drug discovery and reduce the consumables for new drug discovery, real-world data show that the use of AI technology can reduce the cost by about 35% [7]. Looking back at the net income trends of major international pharmaceutical companies in recent years, it is not difficult to find that most pharmaceutical companies have achieved impressive net income performance after starting to apply AI. For example, Amgen has grown from US$1.98 billion in 2017 to US$8.93 billion [8].

▲Figure 4: Net income of 15 global companies before and after applying AI (US$ billion)

Source: Deep Knowledge Analytics

- Improving prediction accuracy, drug efficacy, and safety

Pharmacokinetics and pharmacodynamics are based on having an accurate understanding of the three-dimensional structure of the compound and its mechanism of action. Traditional new drug discovery can only evaluate a limited amount of data at a time, increasing the possibility of deviation. Meanwhile, AI can read all relevant databases, use deep learning to quickly analyze big data, and confirm the interaction between the drug and the target, thus providing better predictions overall. For example, AI deployed by BMS can be trained to find patterns related to CYP450 inhibition in the data, and the prediction accuracy is improved to 95%. Compared with traditional methods, the failure rate is reduced by six [9].

- Providing a simple manufacturing process

Generally, after a successful AI drug screening, the system will generate a relatively simple manufacturing process, which facilitates and improves clinical research efficiency.

- Multi-specific targeting

Complex diseases such as cancer and Alzheimer’s disease involve hundreds of proteins, and it is difficult to have sufficient effects by going after only one target. AI technology can try to find compounds that interact with dozens of target proteins but avoid interactions with undesired proteins.

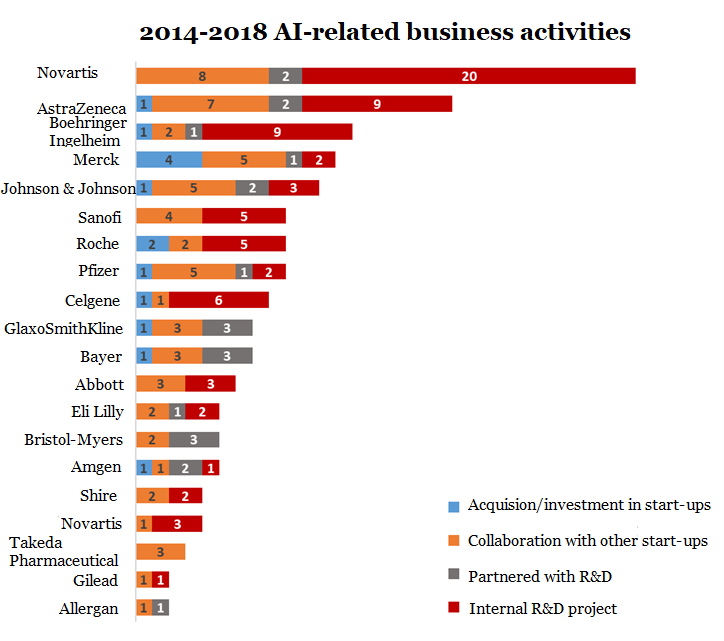

All major international pharmaceutical companies have deployed AI; AI startups have seen rapid growth in fundraising

From 2013 to 2018, the number of AI-related business operations (such as mergers and acquisitions, collaboration, self-development, etc.) of international pharmaceutical companies reached 170. Almost every international pharmaceutical company collaborates with at least one AI company [10]. Pharmaceutical companies such as Pfizer, GlaxoSmithKline and Novartis have also established internal AI research teams.

As a pioneer in the AI field, AstraZeneca released 65 AI-related new drug discovery and R&D related literatures in 2019 alone, while Novartis, Johnson & Johnson, Pfizer, Roche and other large pharmaceutical companies released 40 in 2019 about AI-related literature. This is enough to prove that AI has received the focus of major pharmaceutical companies, and it is urgent to deploy AI in production and R&D.

Start-ups in AI-driven drug discovery also raised more than US$1 billion in funding in 2018, and about US$1.5 billion in 2019 [11].

▲Figure5: AI-related layout of international pharmaceutical companies

Source: Drug Discov Today. 2020 Jun 15; S1359-6446(20)30227-0

China is in a period of rapid growth, with frequent investment from pharmaceutical companies and IT giants

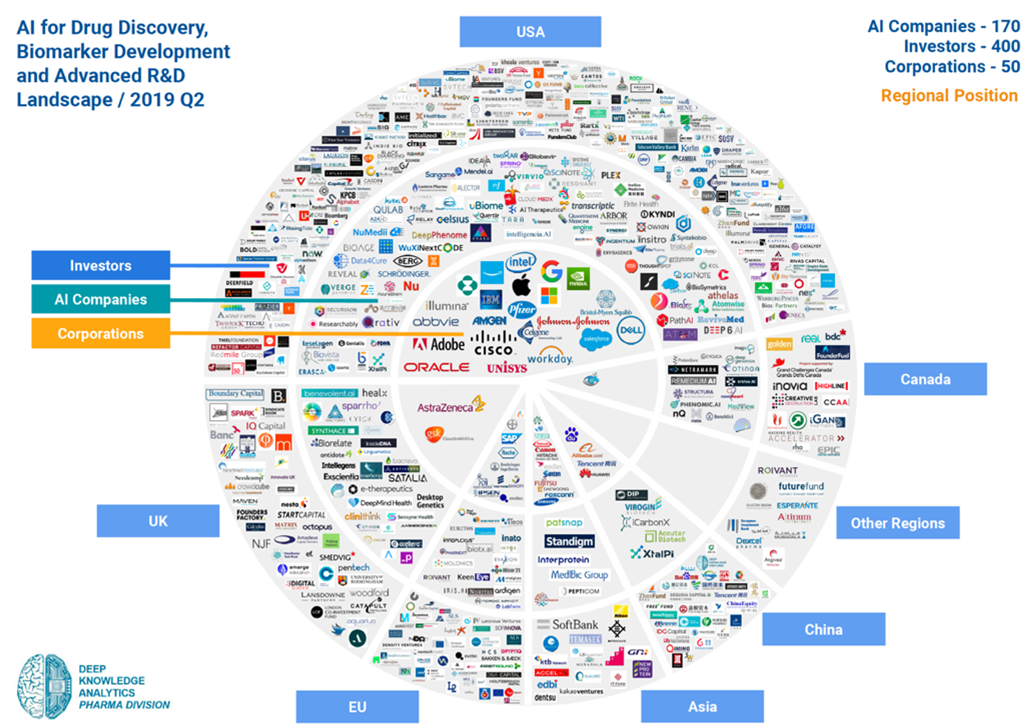

So far, the United States still leads the investment in the field of AI-driven new drug discovery (63.5%). The number of AI-driven new drug discovery companies in the US accounts for 60% of the world [3]. The UK ranks second, and China is in a period of rapid growth.

China stands as the world’s second largest healthcare market. It has faster regulatory approvals and market access benefits compared with other countries, coupled with strong government support. In the future, innovative and digital cutting-edge drug development applications are expected to have further growth in China.

▲Figure 6: AI industry map (by region)

Source: Deep Knowledge Analytics

In fact, China already has the largest number of AI R&D centers (25.7%), surpassing the United States (22.8%). The “New Generation Artificial Intelligence Development Plan” issued by the State Council in July 2017 pointed out that China will realize the highest level of artificial intelligence technology by 2030. The overall goal is to achieve this level through application, coupled with the data advantage of one billion people and the “reverse migration” of highly skilled Chinese professionals from the United States. China is bound to have huge competition in the AI field in the next ten years to come.

Chinese pharmaceutical companies are also following international trends and actively carrying out investment collaborations in the AI field:

- In June 2018, WuXi AppTec and Insilico Medicine established a close strategic partnership to apply artificial intelligence to new drug discovery.

- In June 2019, Simcere Pharmaceuticals took the lead in reaching a cooperation agreement with Baode on HPC high-performance computing and AI platforms to help drug development.

- In September 2019, Hansoh Pharmaceuticals and Atomwise reached a strategic cooperation agreement to develop new drugs for up to 11 targets. According to the agreement, the potential total value of this collaboration with Atomwise will exceed US$1.5 billion.

Chinese start-ups such as AI new drug discovery companies iCarbon X, XtalPi, WI Harper, and Deep Intepharma AI have also been favored by capital.

In addition, Chinese IT technology companies such as Alibaba, Baidu and Tencent have made major investments and acquisitions in the medical AI field, and the number of active Chinese investors in this field is also steadily increasing. The most typical example is that Tencent invested in the AI-driven healthcare company iCarbon X, and jointly invested in XtalPi with Google and Sequoia Capital. Tencent’s portfolio company Yidu Cloud has raised a total of US$337 million since its establishment in 2014, with the valuation of US$2 billion. Alibaba Cloud has also collaborated with Chia Tai‑Tianqing Pharmaceutical to obtain a new compound screening method.

Global AI new drug discovery technology platforms and case studies

Deep Knowledge Analytics has selected 25 leading companies that are using AI technology to discover targets, screen drugs, repurpose old drugs, and design new drugs.

▲Figure 7: AI new drug discovery companies (in alphabetical order)

Source: Deep Knowledge Analytics

Discovery of therapeutic targets

The first step in drug development is to understand the biological mechanism of the disease, based on which, to find suitable targets through high-throughput technologies such as RNA screening and deep sequencing. Finally, integrating diverse data sources to find relevant patterns is an important challenge for traditional methods. In addition, research work is often based on the researcher’s personal experience, which may lead to them viewing the results through a bias and excessively limit the number of targets.

Compared to traditional methods, AI only takes a few seconds to systematically analyze existing literature and data. This real-time database analysis can more accurately understand pathological cells and molecular mechanisms, and it can be used for complex diseases such as neurodegenerative diseases.

In order to discover targets that may play a role in the disease, the biopharmaceutical company BERG uses AI to screen information from human tissue samples. It extracts genomics, proteomics, metabolomics and other data from the patient’s tissue samples, and then deep learning searches the difference between non-disease and disease states and finds proteins that have an impact on disease.

BenevolentAI’s JACS (Judgment Augmented Cognition System, Judgment Augmented Cognition System) technology platform uses AI to extract knowledge that can promote drug research and development from the disorganized mass of information. It can also propose new hypotheses that can be verified, thereby accelerating the process of research and development.

Screening candidate drugs for small molecule libraries

After determining the target of intervention, it is necessary to find a compound that can interact with the target in an ideal way. This process includes screening thousands of potential natural, synthetic or bioengineered compounds and understanding their impact on the target. AI can quickly predict drug candidates from millions of small molecules that can effectively bind to the target, as well as having minimal side effects based on structure and interaction modeling algorithm.

As the first new drug discovery platform based on the structure of small molecules, Atomwise’s AtomNet platform can learn the three-dimensional characteristics of the small molecule combinations and targets the discovery and optimization of lead compounds (such as crossing the blood-brain barrier), within a few days. Atomwise has collaborated with global pharmaceutical companies and 200 universities and hospitals in 40 countries/regions to implement hundreds of projects every year. They have a strong momentum in China, such as the collaboration with Hansoh Pharmaceuticals mentioned above. Atomwise’s investors include Baidu Ventures and Tencent Holdings.

Another method is called network-driven new drug discovery. Through large proprietary databases and tailor-made computing tools, it doesn’t just predict the combination of a drug and a target molecules, but the entire disease-related signaling pathway network for greater impact. For example, e-therapeutics and Novo Nordisk are using the such approach to search for new treatments for type 2 diabetes.

Repurposing old drugs

AI can better understand drug pharmacology. It can also be used for drug optimization and finding new uses for old drugs by determining off-target reactions and toxicity.

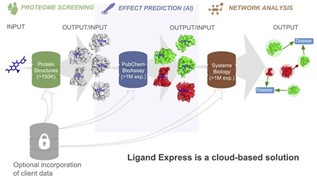

Cyclica has the first cloud proteomics platform (Ligand Express). It screens all protein targets that can be combined with small molecule compounds and uses AI to evaluate the impact of these compounds on protein targets. It also uses bioinformatics and systems biology to present the interactive relationship between drugs and proteins as images. This platform enables a unique and comprehensive evaluation of small molecule compounds. Such information can help improve drug efficacy, prevent drug side effects, and discover new targets that bind to small molecule compounds.

▲Figure 8: Ligand Express platform

Source: Cyclica’s website

In April 2020, Cyclica reached an agreement with the Institute of Materia Medica and the Chinese Academy of Medical Sciences through Z-Park Fund and CCAA.

New drug de-novo design

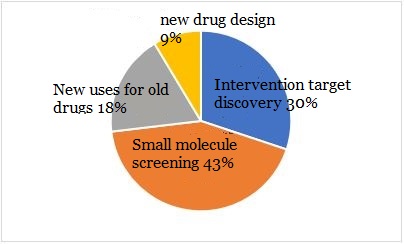

The above three application scenarios are different, but in essence they all use AI to carry out screening and analysis of big data, with a focus on discovery. AI also has led to breakthroughs in new drug design, involving deep learning and automated processes, and focusing on creation. It can be seen from Figure 9 that because of the high technical threshold, the proportion of companies involved in new drug de-novo design only represents 9%.

▲Figure 9: Application classification of AI in discovery

Source: Deloitte

New drug design can achieve precise customized design along with avoiding bias and unnecessary cross-offset in small molecule screening. Insilico Medicine (Hong Kong), led by WuXi AppTec, announced the development of GENTRL in September 2019, designing six new molecules within 21 days at a cost of US$150,000, four of which can be specifically inhibited at nanomolar concentration DDR1.

Although promising, Insilico Medicine, like other AI new drug design companies, is still in the proof-of-concept stage, and its clinical significance needs further confirmation. In the field of new drug de-novo design with AI, Exscientia is undoubtedly the leading company closest to clinical application.

This article will take Exscientia as an important case for in-depth analysis.

Exscientia introduction

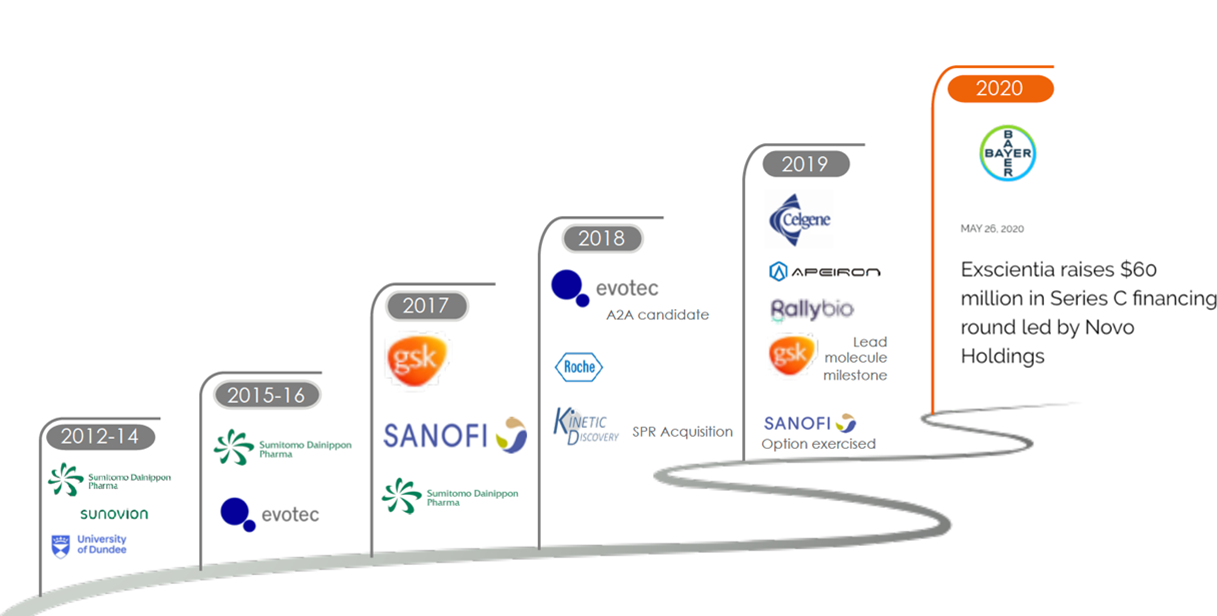

Exscientia is the first company to achieve fully automated drug design. It was established in Oxford, England in 2012, with offices in the United States and Japan, and currently employs 70 people, including 24 AI experts. So far, Exscientia has raised a total of US$1.036 billion. Exscienti raised with US$60 million from Series C financing in May 2020. This round of financing was led by new investor Novo Holdings, with existing investors Evotec, BMS and GT Healthcare Capital (through its LP) participating. Robert Ghenchev, senior partner of Novo Growth under Novo Holdings, joined Exscientia’s board of directors as part of the financing round.

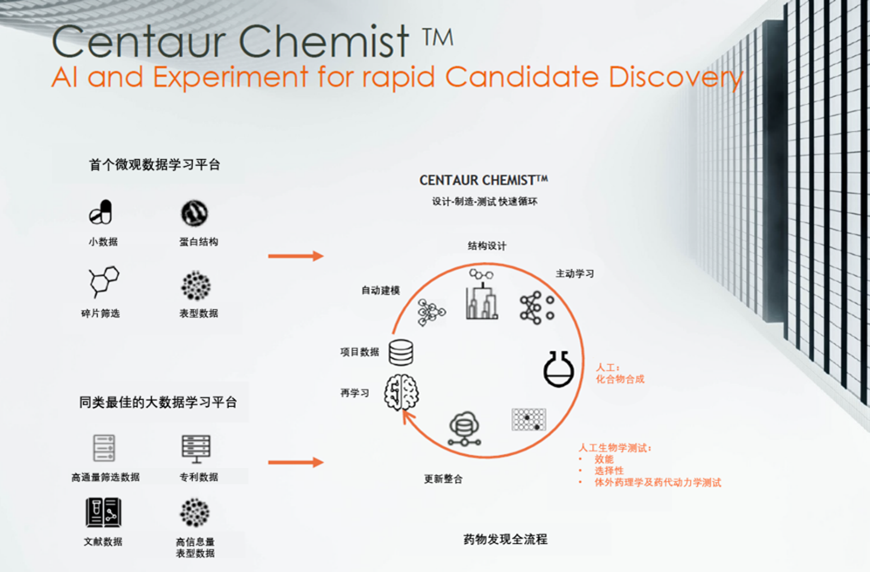

Exscientia has two core platforms. The Centaur Chemist™ platform can fully automate the design of small molecule compounds and calculate priority to select the best chemical structure, thereby achieving a breakthrough improvement in the efficiency of new drug discovery. They can complete a new drug’s design and promote it to the clinic in just one year (the industry benchmark is 4-5 years) with only 85 potential molecules to find a suitable drug (the industry benchmark is 5000-10,000), resulting in cost savings of 80%【9】. Centaur Biologist™ can flexibly analyze and find innovative/hot targets in all disease fields and determine their priorities.

Exscientia currently has more than 20 projects under research/collaboration, of which five new drugs were discovered in less than 14 months. They plan to double the number of pipelines every year.

At the end of January 2020, Exscientia announced that DSP-1181 jointly developed with Sumitomo Pharmaceuticals has entered the first clinical phase for patients with obsessive-compulsive disorder. This is the first time that a drug molecule designed entirely by AI has entered human clinical trials, and the entire development time is only twelve months, marking a crucial milestone in the discovery of new drugs from AI.

▲Figure 10: Centaur Chemist™

Image source: Provided by Exscientia

Application scenarios of the Exscientia technology platform

- Discovery of intervention targets: flexibly analyze and find innovative targets in all disease fields and determine their priorities.

- New drug design: automatically extract phenotypic readouts of key performance indicators, generate and optimize new compounds, and quickly develop compounds that meet key performance standards. This data is fed into predictive models from big data, and active learning from small data, and then input to Centaur Chemist discovery process platform to generate phase I ready assets.

- Design bispecific molecules: In addition to designing new drugs that bind to a single target, Exscientia can also design small molecules that target two different targets at the same time. For example, the two-year collaboration with Sanofi is to develop novel bispecifics from small molecules, targeting two pathways related to the progression of inflammation and fibrosis.

Exscientia’s collaborations

- In 2017, Exscientia signed a US$43 million agreement with GSK to jointly develop more than 10 drugs with different targets. The lead discovery for chronic obstructive pulmonary disease (COPD) was completed in April 2019. The entire process took only 5 cycles and tested 85 potential drug molecules.

- In 2018, Exscientia acquired Kinetic Discovery, a biophysical company. Kinetic Discovery will bring professional protein engineering, biophysical screening and structural biology expertise. Their strengths are highly synergistic with Exscientia’s current AI technology, drug design, and pharmacology, and will further expand Exscientia’s new drug discovery capabilities.

- In Septermber 2020, Exscientia and Huadong Medicine, a Chinese Pharmaceutical company, teamed up for AI-based drug discovery.

- In addition to GSK, many global pharmaceutical companies such as Sanofi, Roche, Bayer, Sumitomo Pharmaceuticals, and others are Exscientia’s partners.

▲Figure 11: Exscientia’s milestones

Source: provided by Exscientia

Exscientia’s competitive advantage

- The current output of new AI drug discovery is very small. Most companies are still in the concept stage and have not been validated. As the first drug molecule designed entirely by AI to advance to human clinical trials, Exscientia has far-reaching clinical significance and has been endorsed by many international pharmaceutical companies.

- 90% of proteins in the human body do not have a crystal structure. Due to lack of sufficient data, most AI and deep learning platforms cannot find compounds that can be combined with the target and meet safety and efficacy standards. Exscientia’s technology platform requires only a small amount of protein-related information. With that information Exscientia can conduct independent deep learning on small data to discover new drugs.

- Exscientia can analyze structured and unstructured data and is also the only platform that can independently learn from multiple omics data (protein structure, phenotype data, fragment screening).

- Artificial intelligence experts account for 33% of all employees. CEO Andrew Hopkins is one of the most prominent and most cited scientists in the field of modern drug discovery. He worked at Pfizer for 10 years. His papers published in Nature are widely regarded as key milestones in the discovery of new drugs from AI.

About the author:

Dr. Ginger Ding is the Director of Investment Analysis at MyBioGate and a advisor for the Texas Medical Center and Columbia University Consulting Club. She has worked at the Howard Hughes Medical Institute and MD Anderson Cancer Center. During the period, she participated in the preclinical research of tumor brain metastasis which received funding from the National Institutes of Health RO1, Susan G. Komen, and Japan’s Taiho Pharmaceutical.

Data Preparation:

Chen Lixing is an investment analyst at MyBioGate. He has a double master’s degree from KGI Graduate School and Drucker School of Management. As a graduate consultant, he provided strategic consulting services for Samumed and SomaLogic.

Translation:

Suzanne Ferguson provided translation assistance for this article.